Skift Take

As long as Shake Shack stays focused on a differentiated product it will remain just fine with consumers, no matter what the short sellers think.

— Jason Clampet

The lines at Shake Shack Inc. restaurants in New York City go out the door. That’s part of the company’s problem, short sellers say.

A record number of investors betting against Shake Shack say the burger chain’s hometown popularity won’t transfer to locations in the rest of the world.

New Yorkers are behind Shake Shack’s rise to become one of the most expensive stocks of any restaurant chain in the world. The company has done it with fewer than 150 restaurants, about 80 of them in the U.S.

More than $420 million of short interest says the stock price benefits unduly from what might be called a New York premium. Wall Street has had a front-row seat to Shake Shack mania, boosted by the chain’s creator, celebrity restaurateur Danny Meyer, and metropolitan customers with discretionary cash who don’t mind paying more for Angus beef.

“They’re never going to do better than they did in New York,” said Howard Penney, an analyst at Hedgeye Risk Management. “There’s plenty of places to get a burger. There’s nothing unique about the model.”

Penney’s main argument is that the chain’s practice of opening restaurants around the world — rather than the typical path of expanding locally, then regionally, then nationally — has never worked in the restaurant industry.

Shake Shack openings outside its hometown are often met with buzz and long lines, but once the novelty wears off, the company will have to spend more on marketing as it struggles to boost sales, Penney said. That would compress margins.

“To me, that means a lower stock price over time,” he said.

Shake Shack declined to comment.

New York

The company makes no secret of the fact that New York is home to its best-performing locations. Its Big Apple outlets boast average annual sales of more than $7 million, while Shake Shacks in the Midwestern U.S. average about $4.5 million. By comparison, McDonald’s Corp. restaurants average about $2.5 million a year in sales with more than 14,000 U.S. outlets.

When Shake Shack went public in 2015, shares skyrocketed as retail investors looked to get a piece of a company popular with millennials, a cohort that was seen as rejecting more traditional outlets, like McDonald’s and Burger King.

Almost instantly, the company, with around 60 restaurants at the time, had a price-sales ratio approaching that of Facebook Inc. About four months after the initial offering, Shake Shack hit a high of $92.86 a share. One reason: Meyer and his colleagues had made few shares available to the public. A secondary offering, priced at $60 a share, helped settle things down. The shares closed 2015 at $39.60 and have traded in that range ever since.

Same-Store Sales

In the early days, short sellers mostly stayed away. Because of the relatively few shares available, and the heavy presence of retail investors, it was expensive to borrow shares to make the short bet, and there was fear of getting caught up in the excitement of a stock that was steadily climbing, said Ihor Dusaniwsky, head of research at the financial analytics firm S3 Partners in New York.

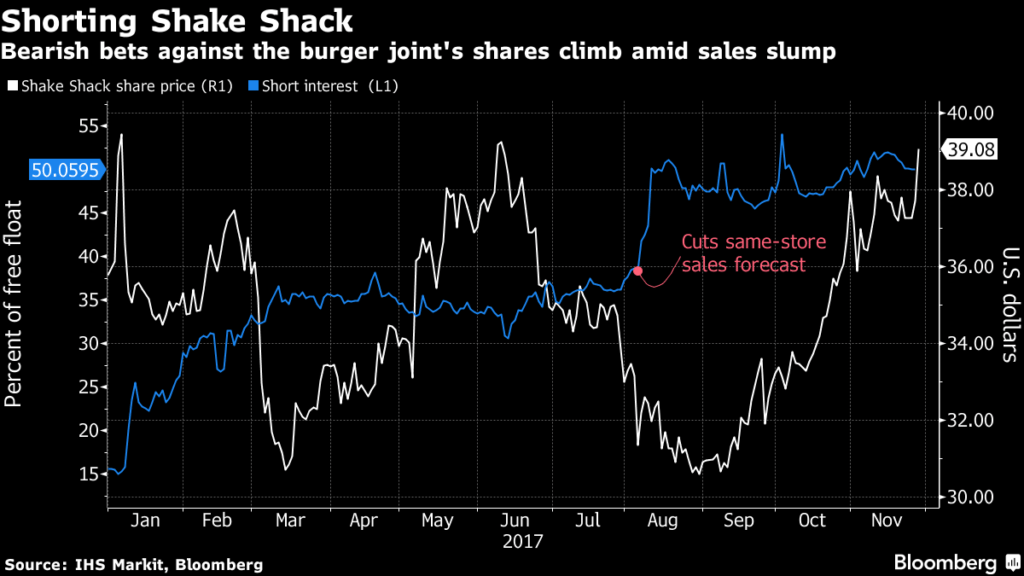

But the short sellers have come out in force this year, spurred in part by a same-store-sales slump that has now lasted for three quarters, at a time when the traditional burger chains lure customers with discount value meals.

“After the IPO, it had too much heat to it,” Dusaniwsky said. “They waited until the euphoria died down. Now they’re shorting the stock.”

Randy Garutti, Shake Shack’s chief executive officer, recently pointed to annual per-outlet sales figures as proof that the company has plenty of room to grow in the U.S. The company has said it wants to expand to 450 U.S. locations and plans to open as many as 35 next year.

Lower Potential

Last year, a report from Michael Halen of Bloomberg Intelligence raised questions about some of the company’s real estate decisions, noting that some of the restaurants opened in 2015 had lower sales potential than existing sites. Those locations help explain the slump in the company’s same-store sales, according to Halen.

Still, Halen said he doesn’t think the stock is necessarily overvalued. “With social media, everybody knows Shake Shack,” he said. “You can blast a tweet and people see it all over the world.”

Sambit Mohanty has the opportunity to eat at any burger joint he wants. But recently, as he waited for his order during the lunch rush at Shake Shack’s original location, Manhattan’s Madison Square Park, the 28-year-old consultant took a moment to admire the higher quality the chain offers.

“It’s the tenderness of the meat that I like so much,” Mohanty said. “It’s a little bit more expensive, but I’m willing to pay for it.”

©2017 Bloomberg L.P.

This article was written by Alexandra Stratton and Craig Giammona from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()