Skift Take

There's still nothing to distinguish Chili's from TGI, Applebee's, Houlihan's, and the rest of the mid-market pack. The food may be cheap-ish, but it's certainly not good, no matter how much you spend on marketing.

— Jason Clampet

Chili’s has a new menu, an inescapable marketing campaign — and not much to show for it.

Brinker International Inc., the restaurant’s parent company, reported earnings on Tuesday that showed diners aren’t particularly hungry for Chili’s.

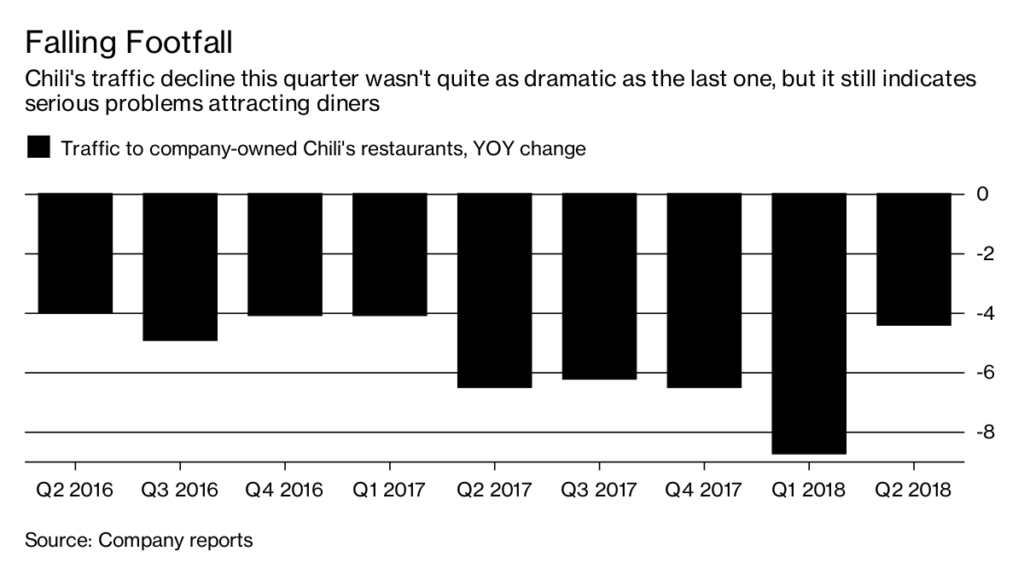

Comparable sales at the chain’s U.S. locations were down 1.6 percent in the latest quarter from a year earlier. And while the year-over-year traffic decline wasn’t quite as steep as in the past several quarters, the brand still struggled to get diners into its doors.

This is not exactly surprising; Chili’s, like much of the casual-dining industry, has been in rough shape for a quite a while now. But the grim performance is especially noteworthy given the chain’s recent efforts to mount a comeback.

Last fall, Chili’s axed 40 percent of its menu items, aiming to reduce complexity in the kitchen and turn tables faster. It was also an attempt to refocus the brand on a few signature items — burgers, ribs and fajitas.

This was a logical move, and it may yet get more traction. Turnarounds don’t happen in a single quarter. Executives said on a conference call with investors that traffic improved significantly in the Thursday-through-Sunday portion of week in the latest quarter, suggesting the menu change has helped with a certain segment of diners.

But I still think there are reasons to doubt a Chili’s recovery. For one, it’s worrisome that it took the chain so long to overhaul its menu.

Olive Garden, the casual-dining comeback kid, began simplifying its menu way back in 2014, pursuing a similar goal of making its kitchens more efficient. Another key Chili’s rival, Ruby Tuesday, launched a new menu in late 2016 with 30 percent fewer dishes. Outback Steakhouse and Carrabba’s Italian Grill — both owned by Bloomin’ Brands Inc. — have also trimmed their menus in the name of reducing complexity.

If Chili’s is going to thrive in this challenging dining environment, then it can’t just play catch-up to competitors.

Plus, executives indicated Tuesday that lunchtime was a real trouble spot in the quarter. It appears its menu updates and messaging haven’t addressed that key dining segment. Once again, that suggests Chili’s is slow off the mark. The lunchtime business at casual-dining chains has been under sustained assault for years now, as fast-casual spots proliferate and grab more of those dollars. If I were a Brinker investor, I’d be concerned Chili’s hasn’t done more yet to adapt.

And it’s good that Chili’s is committing to renovating its entire fleet of restaurants starting in the first quarter of next year. After all, no one wants to eat in a restaurant that feels like a time machine to 2001. But Chili’s has one of the biggest restaurant fleets in the industry, suggesting this could be a rather expensive project.

At a time when its margins are already pressured by rising wages and the bigger servings of meat included on its new menu, that could be a difficult cost to shoulder.

If there was anything encouraging in these results, it was that Brinker said Chili’s will focus more on its to-go and delivery businesses in the second half of the year. These offerings will likely be important growth engines for the wider restaurant sector. And Chili’s has a good base on which to build; already more than 10 percent of its sales are from to-go orders. But it’s hard to get too excited about the potential of such efforts to fuel sales growth when we don’t have a clear idea of what they’ll look like and how speedily they’ll be executed.

To get diners to try its new menu, Chili’s has been running TV commercials that riff on its earworm of a jingle from the 1980s. The ads announce, “Baby, Chili’s is back.”

These latest results show that is still an an aspiration, not a reality.

©2018 Bloomberg L.P.

This article was written by Sarah Halzack from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()