Skift Take

Whether it's virtual reality tourism or online shopping, both are radically improved if you're actually in the destination or store with something delicious to eat and good to drink.

— Michael Schaefer

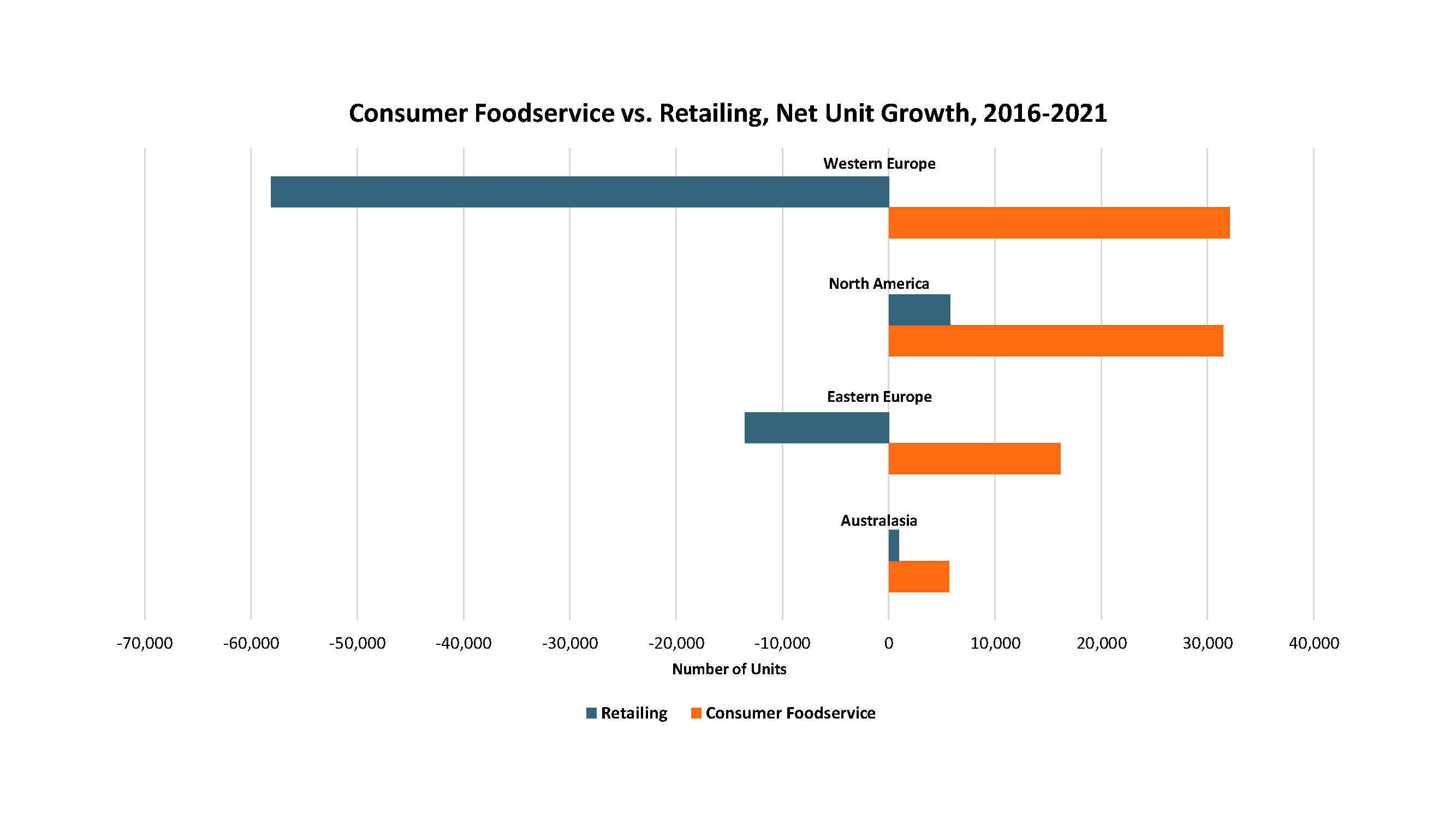

Though references to a “retail apocalypse” in markets like the United States are likely overblown (for now), there is no question that the surging growth in e-commerce is driving a long-term shift in the global retail environment.

Brick-and-mortar retailers and product manufacturers alike fear commoditization (or extinction) at the hands of internet retailers – Amazon above all. Seemingly every retailer and product manufacturer now highlights the importance of a unique, differentiated experience as a means of supporting their brands and driving consumer attention.

Many of these brands are now experimenting with foodservice environments as a means of providing these types of differentiated experiences. While retailers have long offered onsite dining, and product brands of all types have always sold into foodservice channels, what is happening now represents something quite distinct. More brands than ever — from furniture retailers to food and drinks manufacturers to hotels, among others — are actively building branded, foodservice environments which they control directly.

The key shift is in terms of control — control of branding, consumer attention, how products are discovered and experienced. The current retail environment is nothing if not a battle for consumer attention — in a fragmented advertising environment, restaurants can serve as a way for smaller brands to cut through the noise. For consumers, restaurant environments offer a means of discovering and trying out new products under ideal conditions. For brands, they are a vital source of information on consumer behavior and preferences, driving more targeted innovation. Finally, and as always, foodservice is a valuable new traffic stream, particularly as foodservice spending globally continues to grow.

Source: Euromonitor International

Pop-Ups and ‘Try Before You Buy’ Opportunities

As noted, restaurants and shopping have long gone hand-in-hand. High-end restaurants helped to define the department stores of yesteryear, allowing weary shoppers to refuel and recharge without leaving. Likewise, for many, Swedish meatballs are a vital part of any trip to IKEA, a testament to how the right foodservice offer can also reinforce a retailer’s brand identity and drive additional traffic streams.

In recent years, however, more brands have begun using foodservice environments not just as traffic or branding drivers, but as real-life showrooms, offering customers the chance to spend a few hours with their products prior to buying.

In late 2016, for instance, IKEA opened a pop-up dining club in London’s trendy Shoreditch neighborhood. A multi-purpose cooking and dining space, the club offered customers the chance to host a DIY dinner party, with selected winners using the facilities to prepare food under the supervision of an expert chef.

While bolstering IKEA’s lifestyle brand credentials, the two-week pop-up event also made it possible to try out IKEA products in an organized, guided space, allowing a degree of interactivity not yet possible in IKEA stores. It also points to a future where IKEA offers an array of “lifestyle solutions” beyond single pieces of inexpensive furniture. Finally, dining out and entertaining friends are fun activities, strengthening an emotional connection with a brand that already furnishes the apartments of millions of under-40 urban consumers.

Like most pop-ups, IKEA’s dining club was primarily a marketing exercise, and possibly a testbed for future store concepts. Yet there are numerous examples of permanent, brick-and-mortar restaurants, which serve as active showrooms for products, where the same plates and cutlery used in the restaurant are also available for sale. In December of last year, The New York Times profiled La Mercerie, the in-house restaurant of Roman and Williams Guild, a SoHo-based housewares store operated by the Roman and Williams interior design group.

Though La Mercerie is not the first restaurant to offer this capability, nor the first to partner with a design store, it is notable in the way everything — from cutlery to flowers to dishes – are available to purchase. The dishes on the menu complement the items sold, while offering an interactive way for shoppers to envision how a range of eclectic housewares might fit together in their own homes. Combining curation, artistry, and social activity, it represents a memorable experience, at the very least, while offering clues as to how retail needs to evolve in an internet-centric world.

Way-Station or Way Forward?

While there is no question more retail businesses are exploring foodservice, it is an open question as to just how important these new retail/foodservice hybrids will be going forward. Certainly ongoing advancements in virtual reality technologies could provide a whole new world of immersive shopping experiences for brands like IKEA. Yet for many brands, what foodservice provides – curated products, controlled experiences, social engagement, (relatively) long-term consumer attention – will remain highly attractive. Not all of these new approaches will work — actually operating a successful restaurant remains as challenging as ever, of course. But the fact that a whole new range of players – from product manufacturers to retailers, media groups and others – are looking at the restaurant, breaking it down, exploring the experience with the primary aim of creating something entirely new is exciting and interesting.

Euromonitor International, a Skift Content Partner, is a leading provider of global strategic intelligence on consumer markets, with a network of 800 in-country analysts worldwide.

Michael Schaefer is the Global Lead for Food & Beverage at Euromonitor International. He and his team track consumer trends, product innovations, and the evolution of eating and drinking across the world. Michael is the primary driver for design, development, and promotion of Euromonitor’s global restaurant research program, as well as its coverage of the global non-alcoholic drinks industry.