Skift Take

Turns out, it's really hard to distance yourself from the company's racist founder when his name is blazed across every pizza box.

— Erika Adams

It’s Papa John’s International Inc. founder John Schnatter who’s in the hot seat, but workers at some franchised locations are also getting burned.

That’s the case in Nederland, Texas, about 90 miles from Houston, where Schnatter’s racist remarks have been followed by a double-digit decline in sales, according to franchisee Judy Nichols. That’s forced her to cut employees’ hours, and delivery drivers aren’t getting the tips that they used to.

“Our phones aren’t ringing like they generally ring,” said Nichols, who owns three locations in the area. “It’s hitting us suddenly, which means we have to respond dramatically for our financial survival.”

Another Papa John’s franchisee in the Mid-Atlantic region said sales are down almost 10 percent, while the owners of about 120 locations in Florida have sought to distance themselves from the founder.

“We want to make it clear that we do not share the same sentiments as the founder of Papa John’s, John Schnatter, who recently resigned as chairman of the board,” a group representing about 50 restaurants in Tampa said earlier this month. Owner groups from central and south Florida issued similar statements.

The reports of declining sales show store owners are bearing the brunt of the fallout after the news exploded that Schnatter, who until recently was the company’s chairman, used a racial slur on a call with a media agency. Papa John’s is about 79 percent franchised domestically, meaning independent owners operate the restaurants.

Precarious Position

Stifel analyst Chris O’Cull said this week that the company is in a “precarious position,” with brand damage increasing after Schnatter’s offensive language. Consumer sentiment is “extremely negative” and domestic comparable sales have declined in the mid-teens since the news emerged, O’Cull said, citing channel checks.

“Given the franchisor’s actions have put the franchisees in this unhealthy financial condition, we expect the company may need to provide some royalty relief or other financial assistance to keep franchisees from closing restaurants,” O’Cull said in a note to clients. He downgraded the stock to sell from hold.

Papa John’s has tried to mitigate the situation by ramping up communications with franchisees over the past several weeks, according to a person familiar with the situation. The company has hosted webcasts led by Chief Executive Officer Steve Ritchie, held one-on-one discussions with store owners and sent out emailed memos with updates, said the person, who asked not to be named because the matter is private.

Schnatter, 56, is the company’s largest shareholder, controlling about 29 percent of the stock. He resigned as chairman earlier this month after reports that he used a racial slur and graphic depictions of violence against minorities during a conference call with a media agency in May.

While he admitted to using the offensive term and apologized, he also said his comments were taken out of context. Schnatter also attracted criticism last year after he lashed out at the NFL for its handling of protests by players against inequality and police brutality. Fallout from that episode, coupled with declining sales, led him to step down as CEO in January.

Heightened Competition

The bad publicity comes as Papa John’s was already struggling to compete with a resurgent Domino’s Pizza Inc., which has seen sales jump as its low prices and mobile-ordering options resonate with diners. Yum! Brands Inc., meanwhile, is renewing efforts to improve sales at its Pizza Hut unit and has replaced Papa John’s as the NFL’s sponsor for the 2018 season.

Papa John’s, whose U.S. restaurant count shrank by 17 last year, has tried to improve its value image and tout its cleaned-up ingredients. Same-store sales growth for domestic franchise locations started slowing steadily in 2016 and has turned negative for two straight quarters.

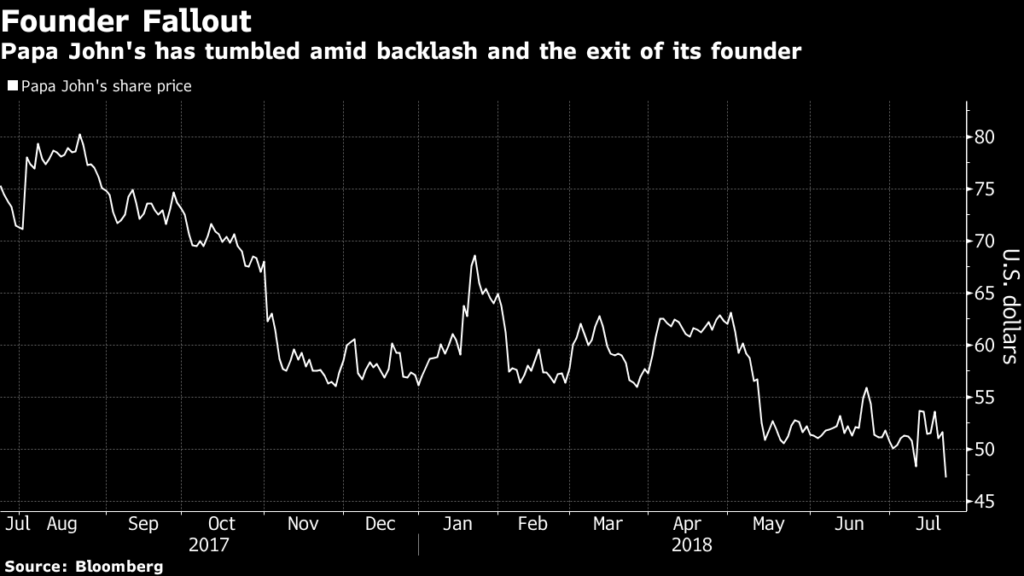

Papa John’s shares have dropped 10 percent so far this week, after the company adopted a poison pill to thwart any efforts by Schnatter to gain a majority stake in the chain. The stock has tumbled about 39 percent in the past year.

External Probe

Earlier this month, the company’s board terminated its so-called founder’s agreement that designated Schnatter as the face of board and hired a law firm to oversee an investigation of its “policies and systems related to diversity and inclusion.” The company declined to comment.

While some franchisees may be suffering, others see a buying opportunity. Denny’s Corp. franchisee Ajay Keshap is in the process of buying about 20 Papa John’s restaurants in the Seattle area. He says the brand’s improved menu gives it a leg up on the competition, and that the company needs to rely on this line of marketing to help sales as its rivals go toward cheaper ingredients.

Even so, the company’s crisis “probably will affect the brand a little bit,” he said.

©2018 Bloomberg L.P.

This article was written by Leslie Patton from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()