Skift Take

Labor costs took up 36 percent of Cheesecake Factory's total sales, and management isn't happy with it. We expect to see the company testing different methods of labor cost-cutting in the near future.

— Erika Adams

Investors are losing their sweet tooth for Cheesecake Factory Inc.

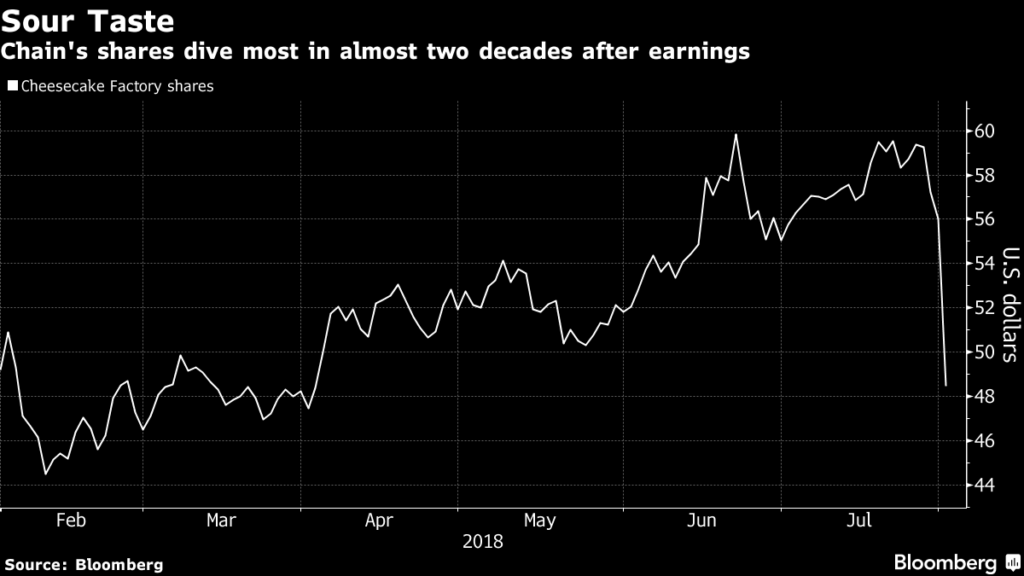

They sent the shares down the most in more than 19 years Wednesday after the restaurant chain posted second-quarter earnings that missed analysts’ estimates and lowered its full-year profit forecast.

While same-store sales matched estimates last quarter, the company cited rising labor, group medical insurance and legal costs for hurting the bottom line, according to its earnings statement. Chief Financial Officer Matthew Clark said on a conference call late Tuesday that increases in the minimum wage pushed labor costs up to almost 36 percent of revenue. Cheesecake Factory isn’t alone in its struggle as restaurants nationwide compete for workers in a tight labor market while minimum wages have risen recently in several states and cities.

The shares tumbled as much as 14 percent to $48.03 in New York, the biggest intraday decline since January 1999. The stock had been up 16 percent this year through Tuesday’s close.

Excluding some items, profit in the second quarter amounted to 65 cents a share, far below the 80-cent average estimate of analysts. The company now sees full-year earnings of $2.40 to $2.48 a share, down from a previous outlook of $2.62 to $2.74.

“We have limited confidence in a positive top-line or cash flow surprise on the horizon,” Wells Fargo & Co. analyst Jon Tower said in a note to clients Wednesday.

Cheesecake Factory cited $4.6 million in higher group medical insurance costs year-over-year and $4.5 million in increased legal expenses. Executives didn’t give details about the legal costs except to say there are a number of current litigations.

Clark said the insurance costs led to a 7-cent negative impact on profit in the quarter, though said that since the company is self-insured, that approach is still more cost-effective over the long term.

©2018 Bloomberg L.P.

This article was written by Uliana Pavlova from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()