Skift Take

When the Chinese chain competition is offering healthier menu options and free massages and manicures to waiting customers, a bucket of chicken from KFC falls a little short in comparison.

— Erika Adams

A Chinese consortium including Hillhouse Capital is planning to drop its pursuit to take over the operator of KFC and Pizza Hut restaurants in China, Bloomberg reported. The interest in Yum China Holdings Inc. fell away after the group’s initial bid was rejected and the would-be investors deemed that business conditions for the fast-food chain and China’s macroeconomic picture have worsened, according to people with knowledge of the matter.

Here are some caveats facing investors eyeing the restaurant scene in the world’s most populous country.

Slowdown & Trade War

- Chinese consumer spending is softening. Retail sales in July posted annualized growth of 8.8 percent that missed analysts’ estimates and stood close to a 15-year-low

- KFC, the big draw for Yum, unexpectedly saw same-store sales growth go flat last quarter while Pizza Hut sales fell 4 percent; CEO Joey Wat said there was “some softness in consumer spending” as competitors focused on promotions

- Starbucks also reported same-store sales dropped 2 percent in the most recent quarter, while McDonald’s CEO Stephen Easterbrook said in July that guest count growth was negative for China through the quarter

- A trade war between the U.S. and China risks hurting Yum China’s business. While a full-out trade battle is unlikely to affect the chain’s procurement or costs, it could incite anti-U.S. sentiment and hurt sales at Pizza Hut and KFC as consumers shift spending to other restaurant brands, Bloomberg Intelligence analyst Jennifer Bartashus wrote in August. Chinese protesters have targeted KFC and other Western brands before.

Evolving Palates

- Millennials looking for healthier options and local fare are turning to Chinese chains that bring entertainment and tech innovations to dining

- Diners at Haidilao, which operates more than 270 restaurants specializing in spicy Sichuan hotpot dishes, can get their nails done or shoulders massaged while waiting for tables

- At Alibaba-backed Hema supermarkets, shoppers pick out lobster, crab and other fresh seafood that’s cooked on-site as well as pay for goods with mobile app Alipay

- Pizza Hut, which accounts for about 20 percent of Yum China’s operating profit, “is struggling to resonate with the rapidly changing tastes of the Chinese consumer,” Bloomberg Intelligence’s Bartashus wrote

Fierce Competition

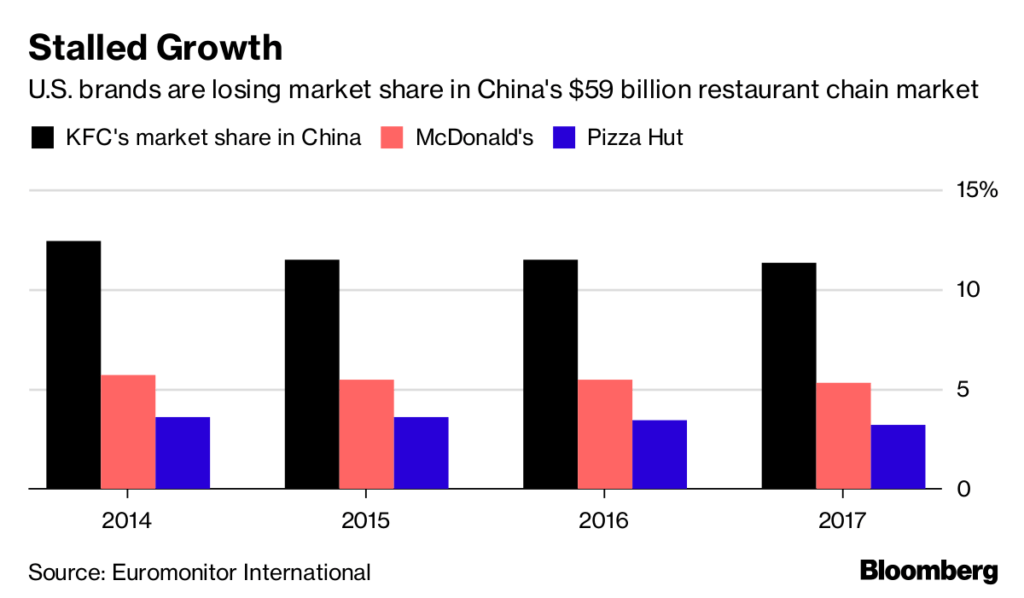

- KFC holds 11 percent of China’s $59 billion restaurant-chain industry, double that of McDonald’s in second place, but the chicken chain’s market share has been gradually falling since 2012

- Hot pot chain Haidilao is said to seek listing approval from the Hong Kong stock exchange and could raise as much as $1 billion in an IPO; it has nearly doubled the number of restaurants since the start of 2016

- McDonald’s China has signed cooperation deals with property developers including Evergrande and planned to double its openings to 500 new stores annually by 2022 since investors including state-backed Citic Ltd. and Carlyle Group bought a majority share of the chain last year

- Yum China, which was spun off Yum Brands in 2016, says it’s not backing down from expansion plans that will see it more than double the number of stores to 20,000

©2018 Bloomberg L.P.

This article was written by Daniela Wei, Jinshan Hong and Bruce Einhorn from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()