Skift Take

Starbucks has made big changes to fix big problems in its biggest markets. For a brand used to significant control over its stores, it will need to make sure that this leads to better operations rather than confusing fragmentation.

— Jason Clampet

Starbucks Corp., already restructuring at home, will now shake things up in Europe, too.

The world’s biggest coffee chain is trimming down its European corporate operations and giving its long-time Latin American partner the rights to open and run cafes in four new countries. Under the licensing deal, Mexico City-based Alsea SAB will be allowed to expand the Starbucks brand in France, the Netherlands, Belgium and Luxembourg, where its presence is relatively limited compared to neighboring markets like the U.K.

The tie-up with Alsea in Europe could help remove distractions from Starbucks Chief Executive Officer Kevin Johnson as he focuses on turning around sluggish sales in the chain’s two most important markets, the U.S. and China. The company declined to share financial details of the transaction.

“By bringing together France, the Netherlands, Belgium and Luxembourg under Alsea, we would be unlocking untapped potential for growth to ensure the long-term success of the region,” Starbucks spokeswoman Haley Drage said in an email.

Job Cuts

In addition to expanding its partnership with Alsea, Starbucks is closing a support center in Amsterdam and will lay off nearly all of its 190 workers there. Four employees will shift to the company’s roasting plant in Amsterdam, which employs about 80 people. Starbucks also is restructuring its London office.

The moves follow the company’s September announcement of a U.S. corporate restructuring, which included layoffs and employee shifts between departments.

The coffee chain is under pressure to improve its business worldwide as demand dwindles for its signature Frappuccinos and customers — who once saw Starbucks as high end — trade up for more premium coffees. Europe’s coffee landscape is also getting more competitive, especially after Coca-Cola Co.’s agreed to a $5.1 billion purchase of U.K. chain Costa.

Activist Interest

As challenges mount, the coffee giant has garnered the interest of a major new shareholder: Billionaire investor Bill Ackman, who announced a $900 million stake earlier this month. He said he believes the company’s shares can more than double over the next three years, noting the chain’s opportunity in China in particular.

The Seattle-based company now has more than 28,000 locations globally, making it one of the world’s largest dining companies. In Europe, the Middle East and Africa, it owns about 500 locations and licenses some 2,700 more. With its large footprint, the company wants to put more responsibilities into the hands of partners like Alsea to manage further growth.

Starbucks plans to sell its existing 83 company-owned stores in France and the Netherlands to Alsea, which will take over store operations, remodels and workers. Alsea will also manage the supply chain for the other 179 locations that are already licensed by other operators in those four countries.

The changes proposed by Starbucks are subject to local regulations, including approval by work councils in the Netherlands and France and an employee consultation in the U.K.

Sales Slog

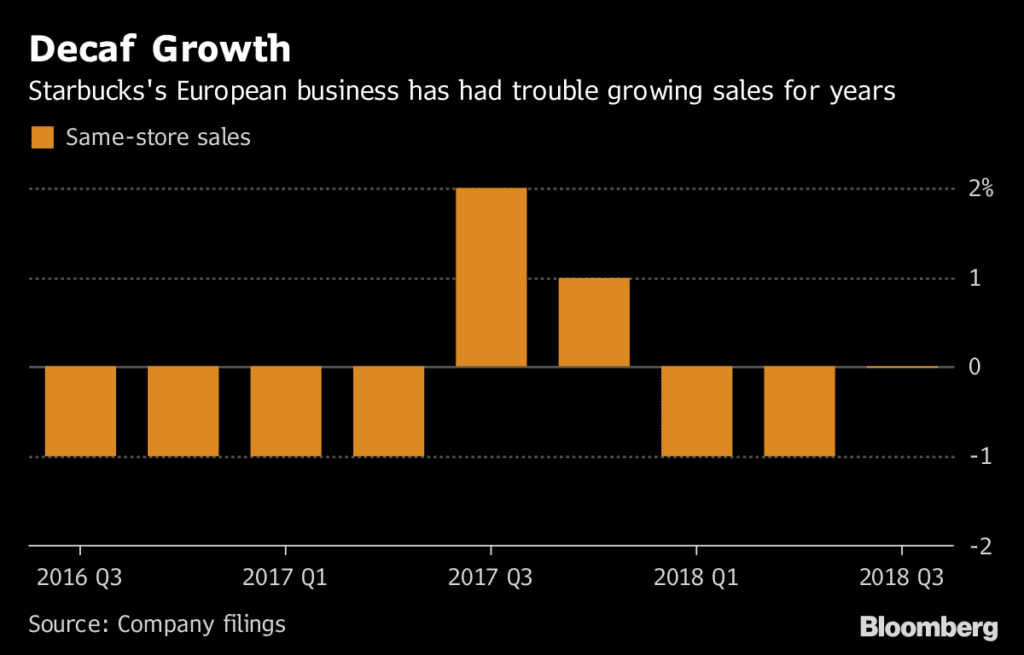

Starbucks’s comparable sales — a closely watched metric for consumer companies — have been under pressure in the region for the last two years, with the company citing economic and competitive headwinds there in its latest earnings call. The chain wants to attract customers by expanding menu items: In France, it recently started advertising a maple rooibos tea latte, along with a new macaroni and cheese with kale dish.

Alsea is well established as a Starbucks partner, first joining forces in Mexico City 16 years ago. It now owns more than 900 of the chain’s cafes across Argentina, Chile, Colombia, Mexico and Uruguay. Alsea already has a foothold in Europe, with Domino’s Pizza Inc. and Burger King restaurants in Spain. It also operates a slew of other brands, including P.F. Chang’s China Bistro and Chili’s Grill & Bar, in Mexico and South America.

Earlier this year, Starbucks got a cash infusion from a licensing deal with Nestle SA — another move that offloads some of its rights in Europe. Now, the Swiss company will be able to sell and market Starbucks coffee items at retailers.

–With assistance from Jonathan Roeder and Eric Pfanner.

©2018 Bloomberg L.P.

This article was written by Leslie Patton from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()