Skift Take

We're not going to be the ones claiming that the old ways are the best ways, but we will argue that we don't know if tech providers and restaurants have thought this through all the way.

— Jason Clampet

Cash may be king for customers with a wallet full of bills, but a growing number of restaurants find accepting paper money just isn’t worth it anymore.

Starbucks Corp. operates one cashless store in Seattle. Sweetgreen, a seasonal salad spot with about 100 U.S. locations, went cash-free last year. Fast-casual chain Chopt Creative Salad Co., which piloted its first cashless restaurant in January, will have six in Manhattan before the new year.

“We were responding to the consumer demand. They told us over time that speed is of the utmost importance,” said Chopt Chief Executive Officer Nick Marsh. Before going cashless, the cashiers couldn’t keep up with the fast pace of food prep, making a “bottleneck at the registers.”

Burdens brought on by cash go beyond the checkout line. As minimum wages rise across the U.S., paying employees to count, secure and transport cash is becoming a cost that some restaurants say they can’t afford. Meanwhile, convenience-hungry consumers used to instant gratification want to get what they ordered as fast as possible—and the customer fumbling with a change-purse slows that down.

For Chopt, the cashless model started at the salad chain’s West 51st Street location in Manhattan, where Marsh said less than 10 percent of transactions were cash previously. As efficiency improved, two other New York City restaurants went cashless in “rapid succession.”

Read More: Payment Tech Creates Haves and Have Nots

For Hill Country Barbecue Market in Washington D.C., cash stopped making economic sense. After losing almost $60,000 from several break-ins from the location this year, CEO Marc Glosserman said making the switch was necessary. The chain’s Manhattan and Brooklyn locations currently still accept cash.

“It made sense for us. Less than 8 percent of our transactions were cash,” he said, noting that handling cash takes about 624 labor hours a year. “Something’s got to give.”

Of course, dropping cash sales means trading the payment method’s costs for digital transaction fees. Morgan Stanley analyst James Faucette said it’s unclear whether a cashless approach can yield higher sales. Still, if a business’s revenue from cash transactions declines as credit card use grows, going cashless won’t be a headwind.

“As a business, you want to get paid,” Faucette said. “Certain businesses will just get to the point where it doesn’t make sense to do cash anymore because of their customer demographic.”

Denying cash-paying customers also raises concerns. Those in opposition say ditching cash discriminates against underbanked populations, who are essentially being denied service at some restaurants because they don’t have credit or debit cards. Washington D.C. council member David Grosso introduced that “Cashless Retailers Prohibition Act of 2018” this summer in an effort to end the trend.

“It’s not as if our main guests are using cash in significant numbers.”

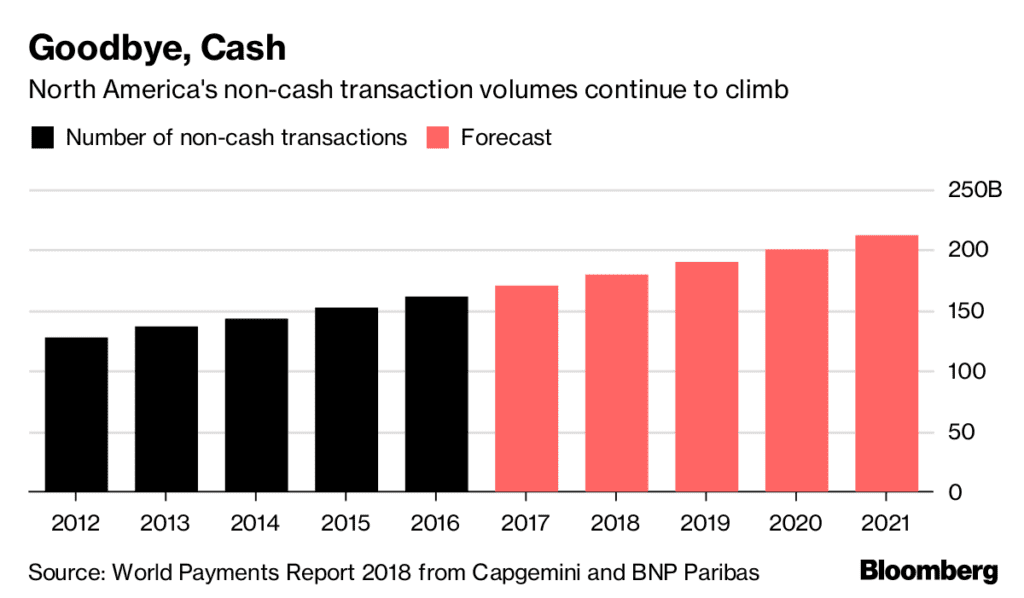

Older guests also tend to prefer cash. According to a survey of rewards credit cardholders from CreditCards.com released in September, 58 percent of Baby Boomers prefer to use cash for purchases below $10, while less than a quarter of buyers between 18 and 27 prefer cash transactions for the little stuff. All in all, physical currency is still the most frequently used payment method, a 2016 Fed study found.

Yet for those companies going cash-free, the pros of stopping the paper trail seem to outweigh the cons as customers increasingly choose the quicker swipe-and-go cadence of credit cards.

“It’s not as if our main guests are using cash in significant numbers,” Glosserman said. “If my core guests are using cash, I’m not sure I’d be so quick to make the change to go cashless. This was the right thing for us to do for our business.”

Intelligentsia Coffee Inc. Vice President of Retail Lori Haughey said the opportunity to streamline the payment process was critical in launching its first cashless coffee bar in Boston this summer.

“If you’re no longer stopping, getting the change, doing that extra transaction, you can reduce that by about 20 seconds,” she said of the checkout process. “If you can pick up 15 or 20 seconds here and there, that will make an exponential difference.”

Another upside to going cashless was implementing handheld points-of-sale that lets cashiers meet customers where they are in line, rather than waiting for everyone to arrive at the same register.

“When you’ve got people ready to maybe walk away because the line’s too long, we can take out that handheld and jump” on that sale, Haughey said. “People are in a hurry these days.”

©2018 Bloomberg L.P.

This article was written by Gerald Porter Jr. from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()