Skift Take

Higher average checks have offset increased wage demands to an extent this year. But with many experts predicting a slowdown in the economy, restaurants are going to have to find another way.

— Danni Santana

An upbeat U.S. economy has been good to the restaurant industry in many ways. Strong consumer sentiment has helped keep average checks growing, as diners shrug off price increases and splurge on bigger orders, and prevented industrywide traffic from falling off a cliff.

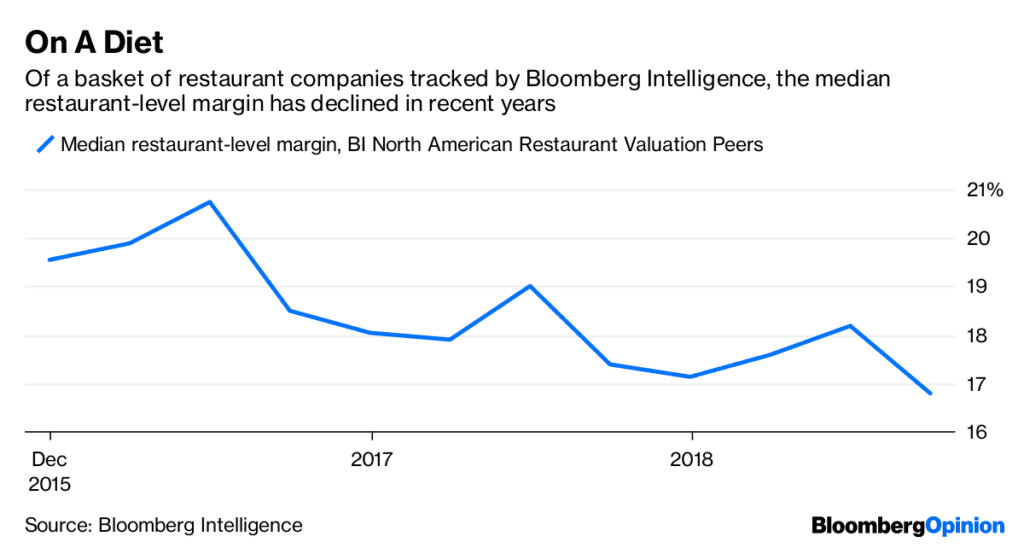

But the healthy economic environment comes with a downside for dining behemoths and their investors. Amid a tight job market, labor costs have become a notable drag on profitability.

This dynamic was evident on Tuesday as Darden Restaurants Inc. reported quarterly earnings. The company, owner of Olive Garden, LongHorn Steakhouse and other eateries, saw a solid 2.1 percent increase in comparable sales in the quarter from a year earlier. But it said labor expense rose to $662 million, up from $622 million in the same period last year.

Darden has been feeling labor-cost strain for several quarters, and it is hardly alone: Cheesecake Factory Inc. has seen its wage expenses swell to 35.6 percent of revenue year to date, up from 34.4 percent in the comparable period last year. Stephen Joyce, the CEO of Applebee’s and IHOP parent Dine Brands Inc., said at a conference this month that labor costs are “a problem, particularly in the city.” It isn’t just in sit-down establishments: Chipotle Mexican Grill Inc. is feeling the squeeze of wage inflation, even as price increases have cushioned the blow.

Of course, restaurants have been dealing with other profit headwinds, including commodity cost inflation, and in certain cases, heated discounting wars. But labor expenses are a major reason for their challenges.

It is possible that this is a pressure valve that will soon release. Consumer sentiment is buoyant now, but there is a growing chorus of economists and analysts who see slowing growth — if not an outright recession — in the months ahead, which could add some slack back into the labor market. But either way, the current labor situation should serve as a strong impetus for the restaurant industry to figure out how to deploy their existing workforce more efficiently. It’s an exercise that can take many different forms.

In the quick-service segment, that might mean investing in self-order kiosks, which could increase how many consumers they can serve and allow a restaurant to free up workers for tasks such as cooking. Shake Shack Inc. is one chain that is testing kiosks as a way to help with labor costs. Casual-dining chains, meanwhile, might try tabletop gadgets that allow patrons to pay their tab without flagging down a server, such as those available at Red Robin Gourmet Burgers Inc.

But there are less-intuitive examples, too, of how restaurants could be throwing technology at their labor woes. Chipotle, for example, is working to digitize the second burrito “make lines” where online orders are assembled. They’ve found that workers complete orders more quickly and more accurately when they’re working from easy-to-read screens instead of paper receipts in tiny lettering.

It will also be worth watching a new effort by Starbucks Corp. to use workers’ time differently. The coffee giant said in an investor presentation this month that a recent assessment found its baristas were spending 40 percent of their time on non-customer-facing tasks, such as cleaning and restocking. The restaurant is now aiming to change processes so that workers don’t have to step away from their stations as often – an effort involving technology that automates some tasks as well as changes such as doing cleanups later in the day.

This kind of experimentation is even more worthwhile when you consider that labor-related innovations can have favorable ripple effects that aren’t immediately obvious. McDonald’s Corp., for one, has seen that self-order kiosks tend to see higher average receipts.

The tight job market should serve as a nudge for the entire restaurant industry to move faster on the kinds of labor and process innovations that will do them a world of good in any kind of consumer environment.

©2018 Bloomberg L.P.

This article was written by Sarah Halzack from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].