Will Digital Ordering Save Chipotle?

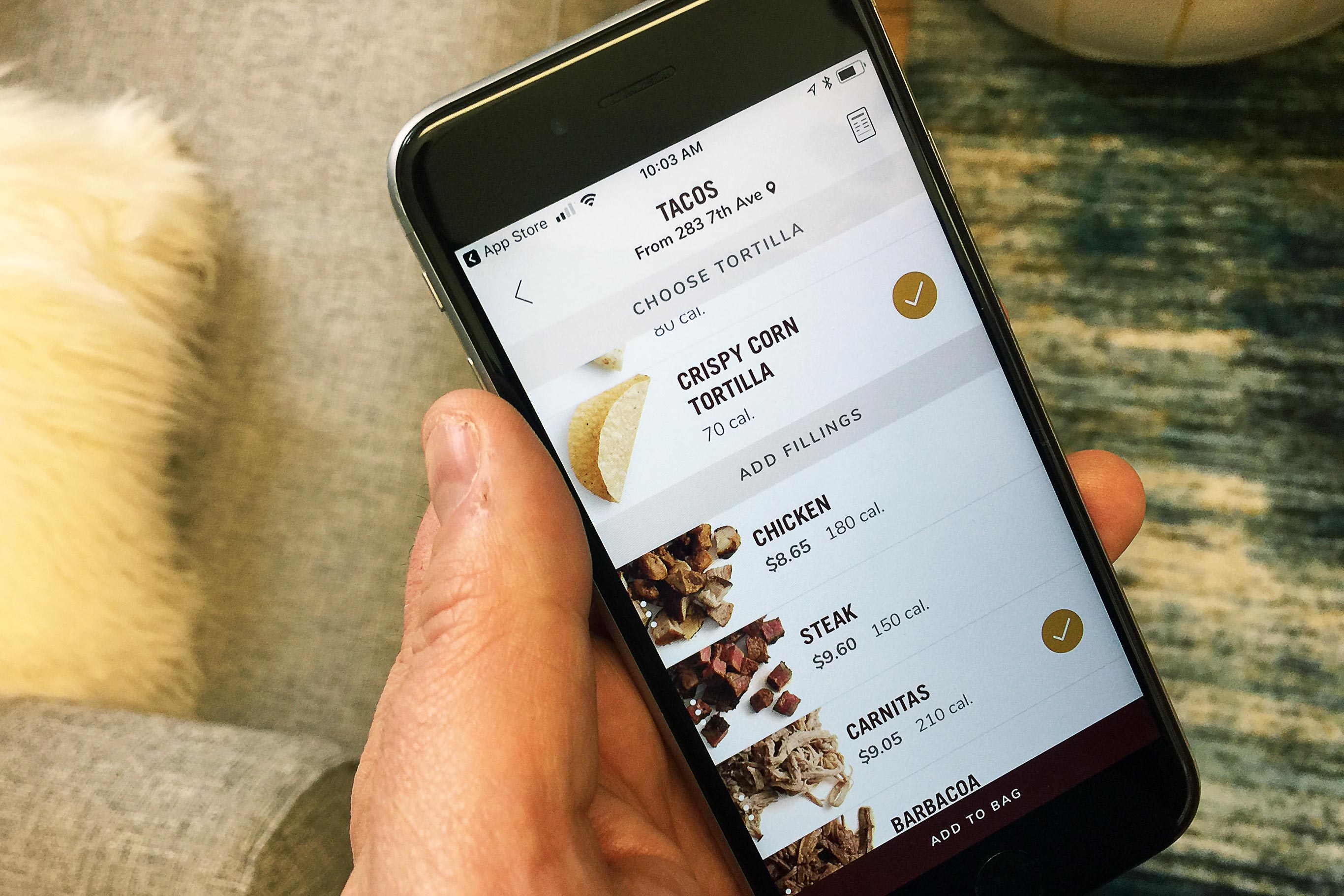

Photo Caption: Mobile orders currently account for over eight percent of overall orders at Chipotle.

Skift Take

Chipotle executives sounded optimistic as they admitted the chain has many obstacles to overcome in order to regain consumer trust and market share.