Grubhub’s Aggressive Growth Fueled by Chain Partnerships

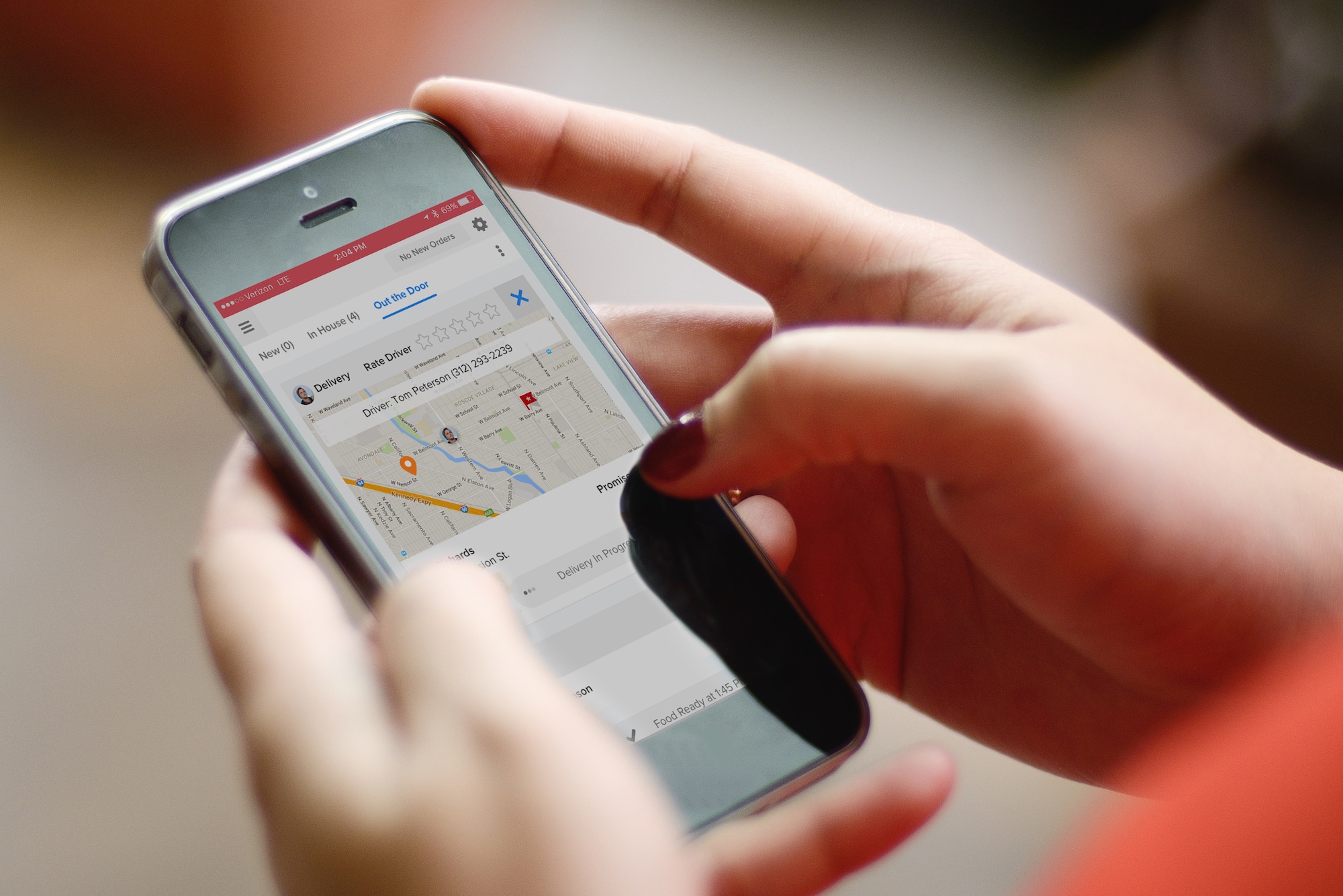

Photo Credit: Grubhub's app. Grubhub

Skift Take

Like everyone in the delivery space, Grubhub has extremely aggressive expansion plans and is looking to shore up as many restaurant chain partnerships as possible. In the race to grab market share, it's positioning itself as the one to beat.