Skift Take

Wagamama's global presence in key markets is a bonus for any acquirer, short-term stock drop or not.

— Jason Clampet

A deal to combine the Frankie & Benny’s and Wagamama restaurant chains left Restaurant Group Plc investors with a bitter aftertaste, as well as having to pick up a chunk of the check.

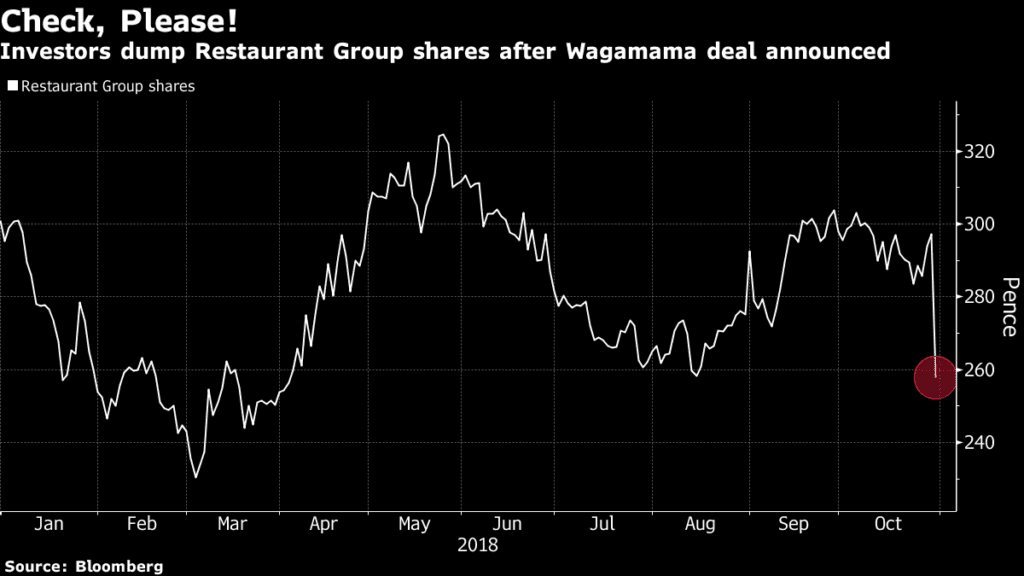

The shares plunged 19 percent on Tuesday after Restaurant Group announced the 357-million-pound ($456 million) acquisition of the pan-Asian chain, a transaction it is asking shareholders to help fund. Analysts suggested the price was perhaps on the high side, and noted it will give the group more exposure to the U.K.’s struggling high street.

While Wagamama’s euro-denominated bonds rose to their highest since January, it was London-based Restaurant Group’s steepest share price drop since the U.K.’s Brexit referendum rocked equity markets back in June 2016.

The deal will be part-funded by a sale of additional shares at a specified price to existing investors, known as a rights issue. That type of funding is usually viewed negatively, given it dilutes the issuing company’s stock. Restaurant Group also said the enlarged group will need to adopt a lower dividend policy, in order to fund its development.

While the dividend outlook and “full price” of the deal spurred a share price decline, Citigroup Inc. analyst James Ainley said the enlarged group should be in a better position to combat challenges faced by the sector, including a continued shift toward both healthy eating and home-delivery services.

Restaurant Group Chief Executive Officer Andy McCue said buying Wagamama — known for seating parties of diners all together on long tables — “is an exciting and transformative opportunity to create a business which can pursue a truly multi-pronged growth strategy.”

It will generate synergies, or cost savings, of about 22 million pounds, and add to Restaurant Group’s earnings per share within the first year following completion, the company said.

–With assistance from Emma Haslett and Lisa Pham.

©2018 Bloomberg L.P.

This article was written by Joe Easton from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()