Grubhub CEO to Rivals: You Can’t Win

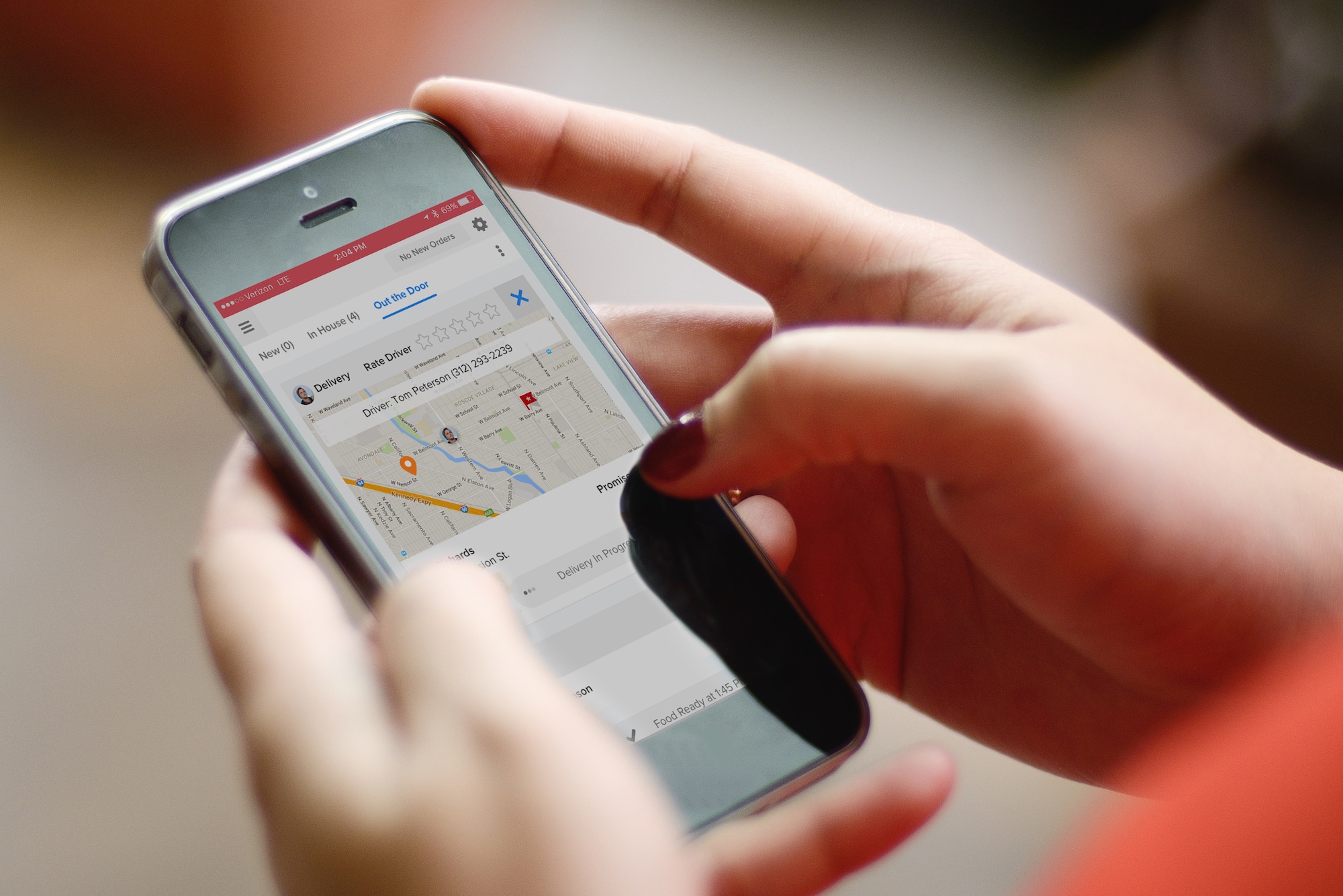

Photo Credit: Grubhub reported its first quarter 2019 earnings on Thursday. Grubhub

Skift Take

Egregious, repulsive, dumb: These are just a few of the words CEO Matt Maloney used to describe his competition’s practices, even as he argued that Grubhub is significantly better positioned to succeed long term.