Skift Take

Becoming the “treat yourself” standard among mall chains is a much better position to be in than the indistinguishable option offered by TGI Friday’s, Ruby Tuesday, Chili’s, and their peers.

— Jason Clampet

The earnings report Cheesecake Factory delivered Wednesday evening was not exactly sweet for investors.

The restaurant chain said comparable sales fell 2.3 percent in the latest quarter from a year earlier. That partly reflected drag from Hurricanes Harvey, Irma and Maria, but comparable sales would have fallen 1.5 percent even without those events. Shares fell on the news, suggesting it made Wall Street even antsier about a chain it had already started to doubt.

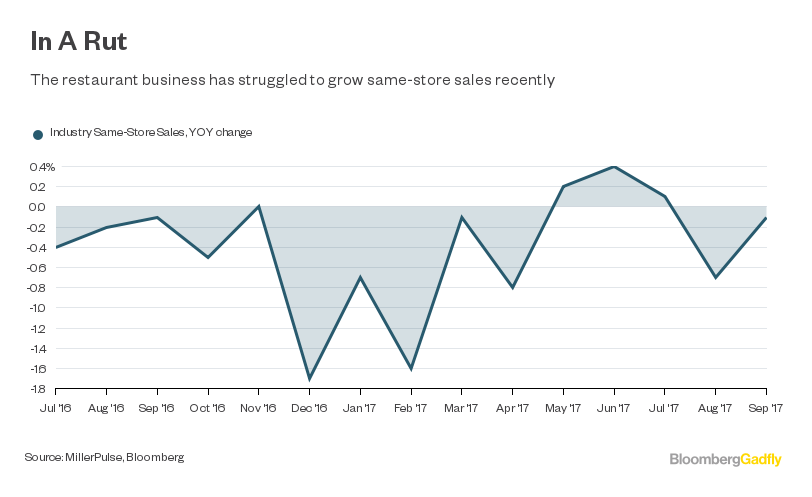

I can see why investors have grown unsure about Cheesecake Factory. Comparable sales have fallen the past two quarters, after an impressive run of 29 straight quarters of growth. That comes as the wider restaurant industry has been in a rough patch, with a sustained streak of soft or declining same-store sales. Some of the biggest names in the casual, full-service dining category are feeling the pain. For example, Brinker International Inc. reported on Wednesday that traffic plunged 8.7 percent in the quarter at company-owned Chili’s restaurants compared to a year earlier.

But I think it’s too early yet for investors to ask for the check at Cheesecake Factory. And that’s because the underlying economics and strategic positioning of the company are so superior to those of its casual-dining counterparts.

$11 Million

On average, an individual Cheesecake Factory restaurant pulls down nearly $11 million in sales per year. No competitor comes anywhere close to generating such a sales haul at a single location.

These robust per-unit sales are a testament to the power of Cheesecake’s brand and its ability to turn tables efficiently. And this strength comes with helpful side benefits. Bloomberg Intelligence analysts Michael Halen and Mariam Sherzad point out that it likely gives Cheesecake Factory enormous power in lease negotiations with mall operators: When you demonstrate that you can drive foot traffic to an otherwise moribund shopping center, it doesn’t go unnoticed.

Meanwhile, even as it has felt the pressure of higher wage costs, Cheesecake has a plan to protect its profit margins, including raising prices and managing its supply chain to keep a lid on food costs.

Plus, unlike many of its rivals, Cheesecake never engorged itself with too many locations. That looks like an awfully smart strategy at a moment when many chains are reckoning with store portfolios the market can no longer support. Ruby Tuesday, for one, last year closed about 100 restaurants.

Without such an albatross, Cheesecake is free to focus on lifting sales. Pickup and delivery will be increasingly important battlefronts for sit-down restaurants, and Cheesecake can continue to channel its resources and innovation toward building those businesses.

It also can do more to increase use of its CakePay app, which lets customers pay tabs on their phones without waiting for a server to deliver a printed check to the table. This could be a powerful tool for boosting throughput and productivity even higher. And it is a clever answer to challengers experimenting with tabletop tablets — a technology that provides efficiency but doesn’t exactly make for an elevated, upscale ambiance.

CFO Matthew Clark, citing customer research, has said Cheesecake Factory’s core diner is “a little bit higher on the income scale.” While consumers broadly feel pretty upbeat about the economy, it’s been especially kind to the affluent. That should be a tailwind for Cheesecake as it tries to entice more diners.

And it’s true Cheesecake is known for gargantuan portions and crazy-indulgent desserts. Given the growing consumer preference for healthier eating, this may seem troublesome. But I think it’s noteworthy that the company has said it saw virtually no changes to customer behavior when it added calorie counts to its menus nationwide. That suggests Cheesecake is seen as a date-night, treat-yourself kind of place. Customers have different priorities on a visit there than when they’re filling their grocery cart or feeding the kids a weeknight dinner.

While many restaurant chains seem to be on a slow slide into irrelevance, I don’t think two weak quarters suggest Cheesecake Factory is in the same position. It has a much clearer reason for being, and a much better market position, than its flailing competitors.

©2017 Bloomberg L.P.

This article was written by Sarah Halzack from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()