Skift Take

Wendy's upgrades in the last few years have made it more fast casual adjacent than just fast food. It will need to do more to distinguish its offerings as McDonald's and others improve food quality and get more creative with pricing.

— Jason Clampet

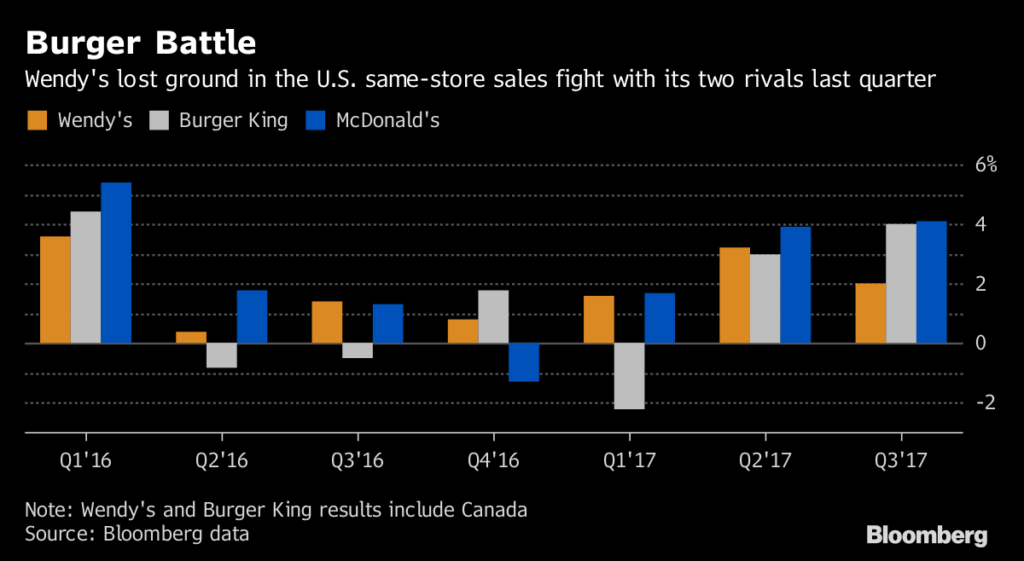

In an increasingly intense fight for fast-food diners, Wendy’s Co. isn’t keeping pace with its biggest rivals.

The restaurant chain posted same-store sales of 2 percent last quarter, short of the growth reported by McDonald’s Corp. and Burger King. The company’s results also missed Wall Street’s estimates, sending the shares down the most in more than a year.

Wendy’s finds itself competing with two reinvigorated chains in the burger wars — especially McDonald’s, which has seen both traffic and same-store sales surge this year. The fast-food industry also is relying more on promotions and discounts to get customers in the door, weighing on profit margins. McDonald’s said last month that it was rolling out a new version of its value-priced menu, upping the ante.

Wendy’s shares fell as much as 7.9 percent to $13.57, the biggest intraday drop since May 2016.

The Dublin, Ohio-based company has been modernizing its restaurants in a bid to attract more diners. Nearly 40 percent of its locations have now been remodeled. But it’s getting harder to stand out in a cutthroat market.

Wendy’s third-quarter revenue amounted to $308 million, short of the $310.3 million estimate. On a same-store basis, analysts had projected a 2.4 percent gain.

Earnings also missed projections. Excluding some items, profit was 9 cents a share, compared with a 12-cent estimate.

Wendy’s expects adjusted earnings of 43 cents to 45 cents a share this year. Analysts have predicted 46 cents on average.

North American restaurant sales will grow 2 percent to 2.5 percent this year on a comparable basis, Wendy’s said. It had previously given a range of up to 3 percent.

©2017 Bloomberg L.P.

This article was written by Nick Turner and Craig Giammona from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()