Skift Take

Up next? We'd love to see a few premium products that bring a halo effect to the arches.

— Jason Clampet

The Golden Arches really shined in 2017: McDonald’s Corp. stock soared as the fast-food giant delivered strong U.S. sales growth at a challenging time for most restaurants.

To keep the momentum going, the company has launched a major marketing campaign around a new iteration of its popular Dollar Menu — called the “$1 $2 $3 Dollar Menu” — which debuted on Thursday.

McDonald’s probably can’t wring much more juice out of its switch to all-day breakfast and speeding up drive-thru lines. So this new overture to budget-conscious customers represents its best opportunity for sales growth in 2018.

A key component of the McDonald’s turnaround so far has been its emphasis on value, with deals like the McPick 2, which lets customers make a combo of two menu items for $5. But the company has said it could do even more to chase price-sensitive diners. At an investor presentation last year, an executive said McDonald’s has lost more than 500 million transactions in its U.S. business since 2012 to competitors, partly because it hasn’t gotten its value offering and messaging right.

Even McPick, which has been broadly successful, is flawed. At one point, it offered more than 120 different combinations, which confused diners and made it hard to weigh McDonald’s deals against competitors’. McDonald’s needs an attractive, easy-to-understand value program if it is going to win back lapsed customers and get existing ones to visit more often.

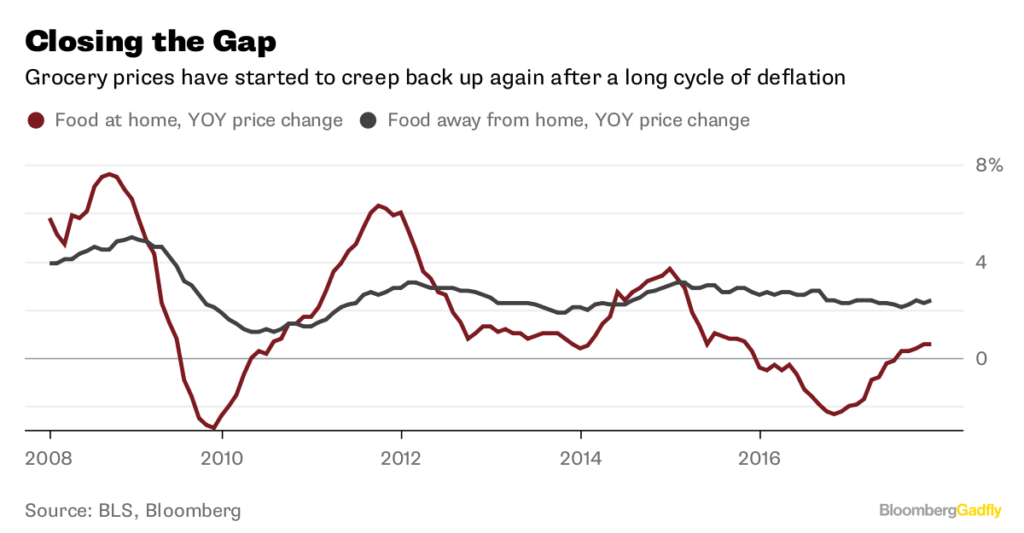

Fortunately for McDonald’s, its new value menu hits just as grocery prices are starting to rise, reversing a trend that had hurt the fast-food and casual-dining industries:

Food-price inflation could push some people away from cooking at home and back to restaurants. If McDonald’s new value menu helps it look cheap relative not only to other fast-food joints, but also to buying groceries, then that should attract diners.

While this represents McDonald’s best shot at an upbeat 2018, the chain will need more than $1 McChickens and $2 Bacon McDoubles to thrive over the long haul.

It’s also important to watch the progress it makes this year on its foray into delivery. The chain has gotten more serious about this lately, saying back in October that it was on track to offer delivery from 10,000 of its restaurants worldwide by the end of 2017.

These days, it’s crucial for any restaurant to experiment with delivery:

But McDonald’s has even more to gain from delivery than some of its industry counterparts.

Sara Senatore, a restaurant industry analyst at Bernstein, has found that breakfast and lunch account for most of McDonald’s sales.

But delivery, she points out, is more of a nighttime business.

As McDonald’s gets more serious about delivery, including a joint venture with Uber Eats, it may get a second look from customers who wouldn’t typically think of it as a dinner or late-night snack option.

Winning back lapsed customers with its value menu and scoring new ones with its delivery program are the keys to McDonald’s shining again in 2018 and beyond.

©2018 Bloomberg L.P.

This article was written by Sarah Halzack from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()