Skift Take

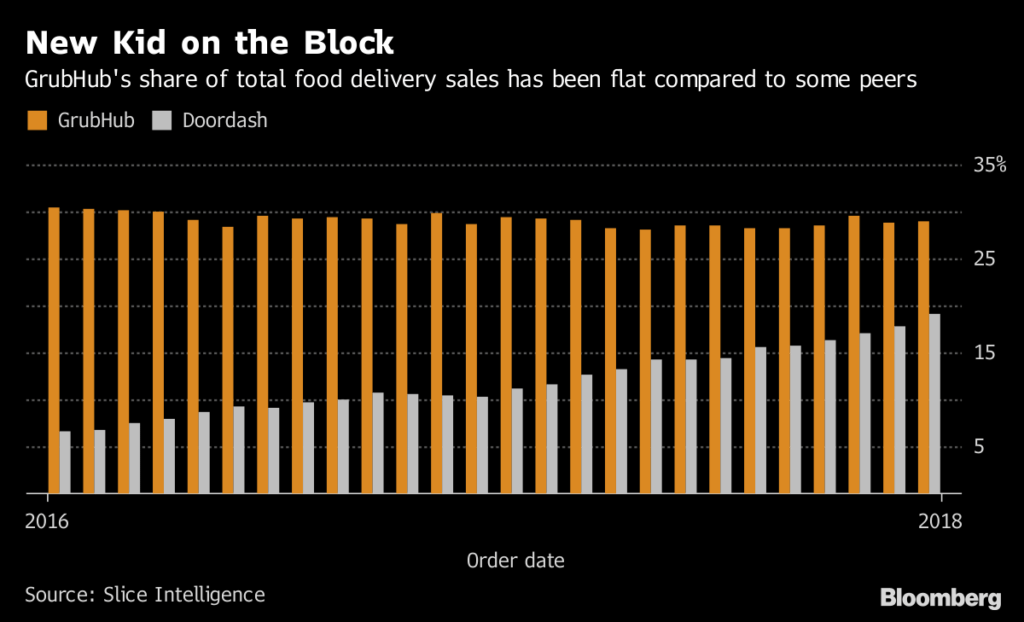

The next great competition in delivery is scale of coverage, but as these services angle for more delivery areas, they could take a hit on operational costs.

— Kristen Hawley

GrubHub Inc. shareholders hungry for a quick payout may be biting off more than they can chew.

The stock has soared 59 percent since GrubHub agreed to a delivery and orders partnership with Yum! Brands Inc. last month. During their dizzying ascent, the shares have blown past all but the loftiest of price targets set by analysts. The stock now trades 17 percent above the average target, among the biggest premiums in the Russell 2000 Index.

Bank of America Merrill Lynch downgraded GrubHub to neutral last week, saying potential catalysts including the Yum! partnership and last year’s Eat24 acquisition are already priced into the stock. Investors are also underestimating the risk that as GrubHub expands its delivery platform, it won’t be able to build its network of partner restaurants at the same pace, according to Mizuho Securities USA analyst Jeremy Scott.

“There’s going to be this gap here for a while as we assess where the long-term picture shakes out,” Scott said in a phone interview. “There’s going to be some costs associated with building this coverage.”

Scott doesn’t expect the addition of the Yum! Brands restaurants to have a material effect on GrubHub’s profitability, though it may help the company lure in smaller restaurant partners. Mizuho’s calculations show that rival UberEats may lose $1 to $3 per order from its delivery agreement with McDonald’s Corp.

As delivery services expand into less-urban markets, there are also fewer drivers available to fill orders. This could pressure operating margins as companies handle fewer orders per delivery batch but need to pay more to recruit drivers, according to Ali Mogharabi, an analyst at Morningstar Investment Service. He sees GrubHub shares falling 45 percent to $61 over the next 12 months, the most bearish view on Wall Street.

“I don’t think the top-line is going to be growing as well as it did the last three, four years,” Mogharabi said in a phone interview. GrubHub’s goal is “delivering at the lowest average cost, and the only way to do that is with scale. Hence the Yum deal. And hence the arms race.”

Part of GrubHub’s targets for geographic expansion will come out of working with Pizza Hut U.S. President Artie Starrs, the most recent addition to the company’s board. GrubHub Chief Executive Officer Matt Maloney said in an interview when the Yum deal was announced that he recognizes Pizza Hut’s “strength in deeper rural and suburban areas of the country” and hopes to learn from its delivery operations and scale.

While analysts agree the Yum deal will eventually help broaden GrubHub’s network of restaurant partners, the near-term picture is less clear.

“We’re trying to assess two different animals,” said Mizuho’s Scott. “We want to have some gravity to our multiples on near-term earnings but also recognize that there’s a pretty bright future ahead that won’t necessarily show up in ‘19.”

—With assistance from Sebastian Silva

©2018 Bloomberg L.P.

This article was written by Justina Vasquez from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()