Skift Take

Meitun has mastered both local discovery and food delivery in a way that has few rivals anywhere in the world. We're not sure what a bike share brings the brand, but we know its rivals and contemporaries are watching closely.

— Jason Clampet

Meituan Dianping, the Chinese food review and delivery giant, is close to acquiring Mobike in a deal that will value the three-year-old bike-sharing startup at about $3 billion, according to people familiar with the matter.

Meituan plans to buy full control of Mobike and allow Mobike’s current management and chief executive officer to keep operating the business as an independent entity, said the people, asking not to be identified because the matter is private. The deal will value Mobike’s equity at about $2.7 billion and Meituan will assume roughly $700 million in debt. Sixty-five percent of the purchase will be in cash, mostly to Mobike management, and 35 percent will be in stock, so Mobike investors will become Meituan shareholders, one of the people said. Meituan and Mobike didn’t immediately provide comment.

Meituan, formed by a merger with Dianping, has grown into a super-app offering everything from group-buying deals and ride hailing to travel packages and payments. With a few taps to navigate its smartphone apps, Chinese customers can order up hot meals, groceries, massages, haircuts and manicures at home or in the office. It is backed by internet giant Tencent Holdings Ltd., as is Mobike.

Mobike was most recently valued at $3 billion, according to researcher CB Insights. China Renaissance acted as the adviser for Mobike.

On Wednesday, Mobike co-founder Hu Weiwei posted on her personal WeChat and included a link to the Nine Inch Nails song “The Beginning of the End”.

“There’s no ‘ouster’ – from my perspective it’s a new beginning,” she wrote, adding that Mobike’s mission had been about improving lifestyles and not just transport. “’Live better’ is also Meituan’s vision.”

Meituan has begun discussions to go public in Hong Kong as soon as this year and is targeting a valuation of at least $60 billion, people familiar with the matter have said. The company is considering listing its shares in China as well if policies allow.

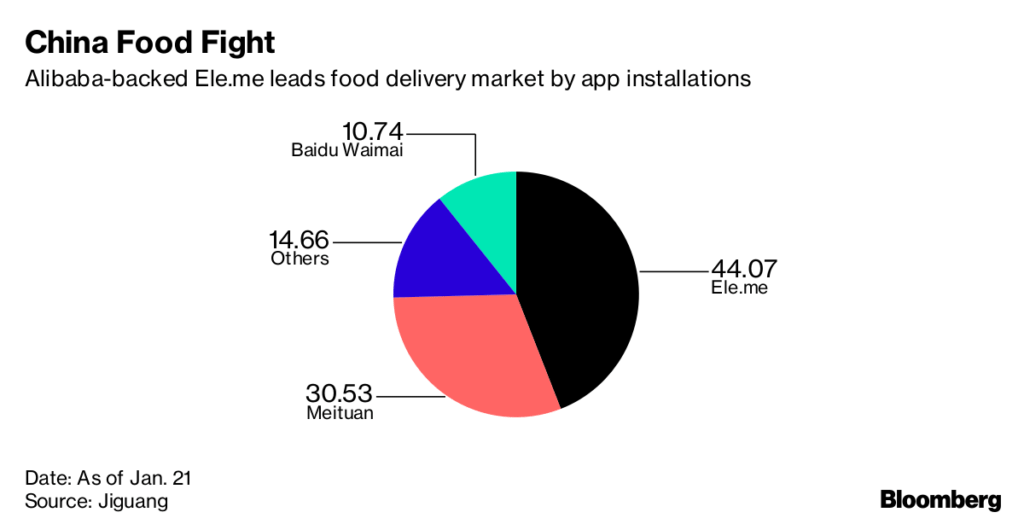

Meituan’s primary competitor is Ele.me, a similar provider of local services backed by Alibaba Group Holding Ltd. This week, Alibaba agreed to acquire full control of Ele.me in a deal that implies a $9.5 billion valuation for the startup.

The acquisition means Tencent now owns a major slice of two markets in direct opposition to Alibaba — on-demand delivery and bike-sharing — and could escalate an ongoing battle between China’s two biggest companies.

–With assistance from David Ramli

©2018 Bloomberg L.P.

This article was written by Lulu Yilun Chen from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()