Uber Eats Doubles Down on POS Integration with orderTalk Acquisition

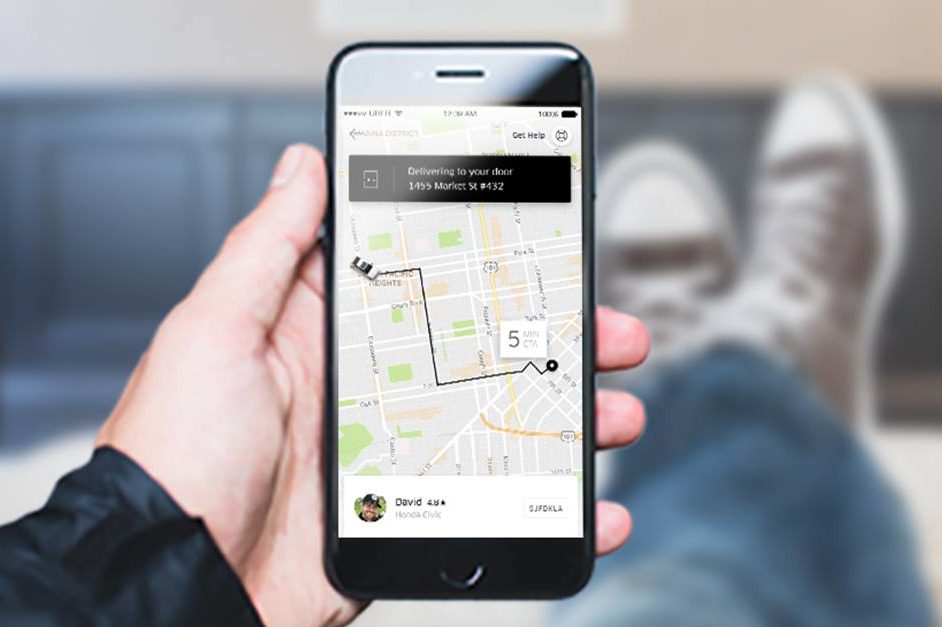

Photo Caption: Uber eats has acquired restaurant technology company orderTalk.

Skift Take

Just as competitors start to pull ahead, Uber Eats makes waves with an acquisition announcement that speaks volumes about its priorities and future strategy.