Skift Take

How badly do Uber Eats or Amazon really need the money-losing Deliveroo? Enough to value it twice what they did a few months ago? That just seems silly.

— Jason Clampet

Will Shu, Deliveroo’s chief executive, is a former investment banker. So he probably knows how to cook up deal interest in a food delivery company whose riders have become a feature of British city streets.

Indeed, back in September, scoops from Bloomberg News and the Daily Telegraph indicated that both Uber Technologies Inc. and Amazon.com Inc. had held early acquisition talks with Deliveroo. Then Sky News reported this past weekend that the London-based firm was looking to raise as much as $500 million from investors.

The new funding round is not because Deliveroo needs the cash, at least according to Sky. Instead it’s supposedly an effort to strengthen its hand for prospective negotiations with Uber, by increasing Deliveroo’s valuation from $2 billion to as much as $4 billion, and thereby setting a floor for future talks.

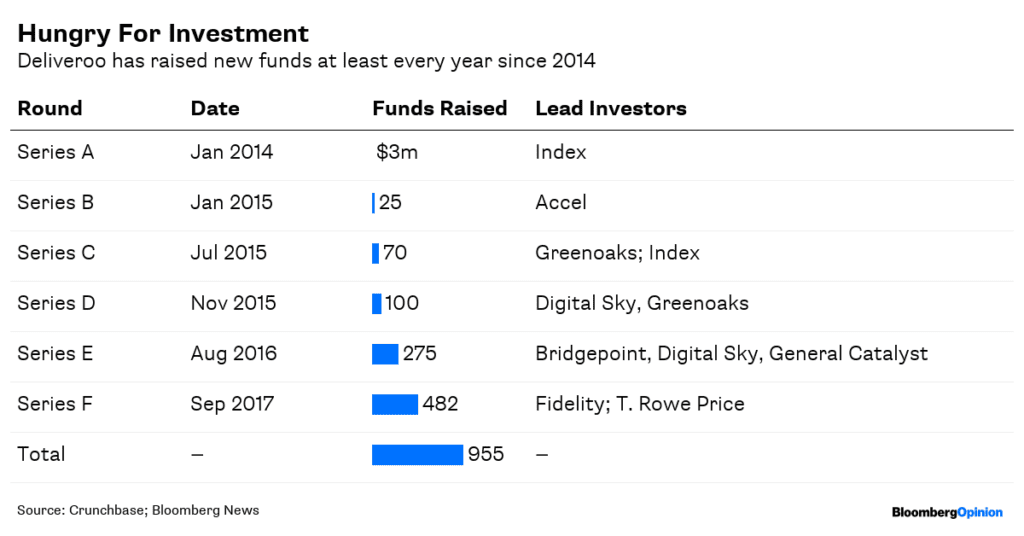

The reality is probably more mundane. Shu seems to be taking advantage of the recent acquisition chatter to raise more money. Deliveroo may still have plenty left over from its other regular funding rounds: It raised $482 million in September 2017. But in an industry that still faces steep competition for restaurants, customers and riders, that’s bound to run out at some stage.

Deliveroo has a host of rivals with much deeper pockets and better access to capital. Besides Uber itself, there is Just Eat Plc and Delivery Hero SE. In Asia, Deliveroo faces rivals backed by Alibaba Group Holding Ltd. and Tencent Holdings Ltd.

The conniptions in the equity markets recently, especially around tech stocks, might also start to weigh on future IPOs. Listed companies whose attractiveness lay largely in their growth prospects have had a tough few weeks, with investors seeking value instead. Deliveroo falls very much into the former category – it’s not profitable yet. So it’s wise of Shu to seize on the Uber excitement to get a new injection of funding, if that’s what he’s doing.

It may well be that the deal hopes are more than just wishful thinking, too, but they don’t seem close. Shu won’t be too worried about that if he can keep the funding taps on.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Alex Webb is a Bloomberg Opinion columnist covering Europe’s technology, media and communications industries. He previously covered Apple and other technology companies for Bloomberg News in San Francisco.

©2018 Bloomberg L.P.

This article was written by Alex Webb from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()