Skift Take

The Starboard-backed pizza chain is in need of stark changes just like Olive Garden was in 2014. But in Papa John's case, all problems lead back to founder John Schnatter.

— Danni Santana

After a dismal year spent grappling with the fallout of offensive comments made by its founder, it looks as if Papa John’s International Inc. has finally found a way to stop its free fall.

The pizza giant announced on Monday that it had received a $200 million investment from Starboard Value LP and that three new directors would join Papa John’s board, including Starboard CEO Jeffrey C. Smith.

There had been a flurry of speculation in recent months about a private-equity takeover of Papa John’s. But whatever other transactions may have been explored, the deal that Papa John’s ended up with is about as good an outcome as the company could have asked for.

That’s not just because a private equity buyout would most likely have saddled it with a significant debt burden. It’s also because Starboard’s investment in Darden Restaurants Inc., the corporate parent of Olive Garden, has been a clear success story. And so it stands to reason Starboard can be a force for good at Papa John’s.

In 2014, Starboard delivered blistering criticism of the Olive Garden chain, such as being too generous with free breadsticks and, most notoriously, not salting its pasta water. Starboard cleaned house, managing to toss Darden’s entire board of directors. And the results speak for themselves.

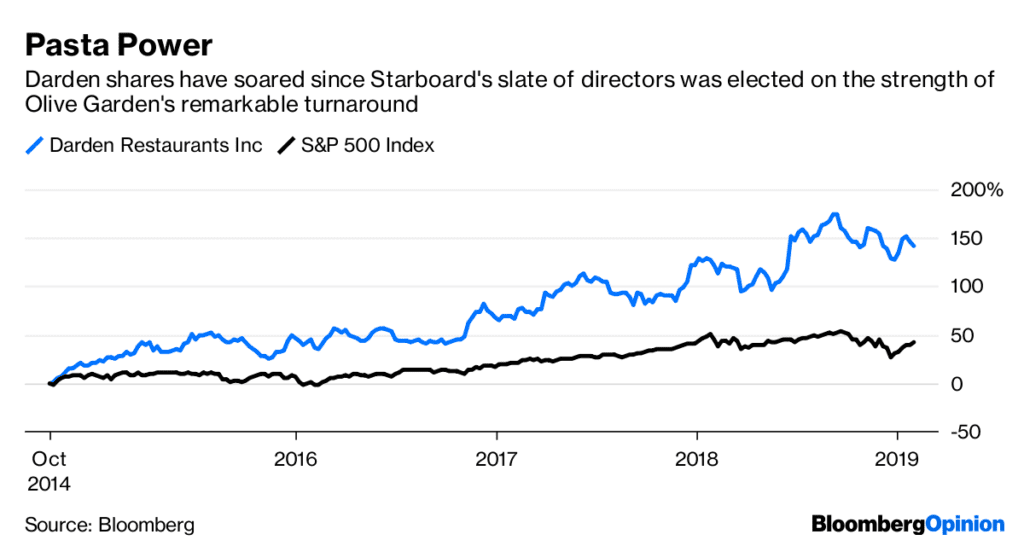

Olive Garden has emerged as a restaurant industry star, delivering 17 consecutive quarters of comparable sales growth. Darden shares have soared since its shareholders elected Starboard’s slate of directors, hitting a record high in September.

That’s a particularly impressive feat given what a tough stretch the past several years have been for the restaurant industry overall as it grapples with oversaturation. The sit-down dining segment has faced the added challenge of diners fleeing for fast-casual formats such as Panera Bread or Chipotle Mexican Grill Inc.

Given that track record, I’m optimistic about what Starboard can do with its slice of Papa John’s. It’s true there might not be quite as much of a jolt with its arrival as there was at Darden, given that only three new directors, including current Papa John’s CEO Steve Ritchie, have been appointed as part of this investment.

But it is enough of a change that it should help the beleaguered pizza chain turn the page on a dark chapter. As I’ve noted before, Papa John’s was struggling well before the Schnatter controversy flared. Its marketing and menu both needed an overhaul, and these are the kinds of problems Starboard can help it address. (The company said about half of the proceeds of the firm’s investment will be used to pay down debt, with the rest going toward advancing strategic priorities.)

The Schnatter-related stains on the brand — related to his use of a racial slur on a business phone call — will be more difficult to fix. The company has been working to redefine its brand with consumers, such as with TV commercials showing that Papa John’s is more than just Schnatter. New board members can help investors believe in that transformation story and a commitment to change.

And that is an urgent message to deliver, because Papa John’s on Monday offered up more evidence of just how dire things are. The company tucked a sales update into its press release about the Starboard news, and it wasn’t pretty. Comparable sales in the North America division fell 8.1 percent from a year earlier in the fourth quarter, which ended Dec. 30. In the month after that, the company said comparable sales in North America fell 10.5 percent from a year earlier, an abysmal result it said reflects both “consumer sentiment challenges” and ineffective promotions.

Securing this investment from Starboard is Papa John’s biggest step yet away from the Schnatter era. Investors are right to reward the company for moving on.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Sarah Halzack is a Bloomberg Opinion columnist covering the consumer and retail industries. She was previously a national retail reporter for the Washington Post.

©2019 Bloomberg L.P.

This article was written by Sarah Halzack from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].