Skift Take

There's been a battle over local discovery in the U.S. and Europe for ages. Meitun's payment- and booking-first approach is clearly the way to go with both consumers and restaurants and bars.

— Jason Clampet

Meituan is the kind of Chinese technology company few people outside the country understand.

That’s because its services aren’t quite like anything you might find abroad. Meituan has a restaurant review feature sort of like Yelp, but its app also lets you order off the menu from your phone the minute you sit down. You can settle your check with the Meituan app, book a karaoke room across town, select a song list and then hail a car for the trip over.

That makes it a serious contender in the super-app stakes, with capabilities to rival WeChat, an app from messaging giant Tencent Holdings Ltd. — ironically one of Meituan’s most prominent backers. The startup is already the world’s fourth most valuable and is emblematic of a new generation of up-and-comers that threatens a cozy duopoly enjoyed by Tencent and Alibaba Group Holding Ltd.

Leading the drive is Wang Xing, a hard-charging 38-year-old who founded the $30 billion behemoth. The inveterate entrepreneur is taking Meituan beyond its base of restaurant reviews and digital coupons into the alien territory of digital payments and even ride-hailing. Meituan already helps more than 4 million merchants hawk everything from food delivery to apartment rentals and travel packages to a user base about the size of the U.S. population.

For now, the giant startup’s careful to emphasize it’s not trying to undermine Tencent, merely testing the waters and harnessing its user base. To that end, it’s opening its platform to third-parties and plotting an expansion into at least 10 new verticals, said Chen Shaohui, a senior vice president overseeing strategy.

“Our services are location-based, that’s why we want our products to cover all aspects of life,” Chen said in an interview. “We are a company that focuses on fast upgrades in our battle strategy. We are very open to seeing what works.”

“In any business we get into, we’ll start small. If it works, then we go big,” he added.

Fueled by $7.3 billion in funding over the past two years, Meituan is the standard-bearer for a gaggle of upstarts from Uber-vanquisher Didi Chuxing to news-video juggernaut Toutiao angling to up-end an industry that orbits around the twin suns of Alibaba and Tencent. They’re charting their own course and already looking beyond China: Didi for one is venturing into bike-sharing and acquiring Brazil’s top ride-hailing service.

Meituan too has come a long way from when it was considered a pawn in Tencent’s internecine struggle against its arch-foe. The company is a leader in “online-to-offline” or internet consumer services, created through a merger of Meituan — then backed by Alibaba — and Dianping in 2015. That $15 billion deal, engineered by Tencent and other investors, was an attempt to curb wasteful spending on marketing and subsidies. Alibaba subsequently went its own way, setting up its own local services unit Koubei with affiliate Ant Financial.

“Meituan and Didi definitely have the ambition,” said Zhou Xin, an internet consultant with Beijing-based Trustdata. “Alibaba and Tencent have been paying close attention to these smaller companies, because even if Meituan and Didi don’t have the clout to overthrow them anytime soon, the smaller two could affect the power dynamics significantly.”

Of the two, Beijing-based Meituan seems more adventurous. Meituan said this month it’s planning to offer taxi and car-hailing services in seven cities including Beijing and Shanghai.

It remains to be seen how Tencent will handle the conflict. Chen brushes aside speculation Meituan’s trying to undermine WeChat, which also offers similar services.

“Meituan has now expanded into every vertical in the service sector,” said Steven Zhu, a Shanghai-based analyst with Pacific Epoch. “The key logic behind all these moves is that it wants to capture as much traffic as possible.”

Payments are an area of focus for Tencent because of its potential to illuminate purchasing behavior. Billionaire Jack Ma’s Alipay still accounts for the majority of online payments — roughly 54 percent as of the end of September. But that’s a far cry from 80 percent just four years ago. Tencent now accounts for about 40 percent, according to research firm Analysys International.

Now Meituan has begun promoting the use of its own digital wallet on its app: it handles about a fifth of transactions from its 300 million-plus users. Tencent accounts for about 60 percent, whereas Alipay and others contribute about 20 percent, Chen said. And it’s now offering to connect third-party merchants and service providers to its own back end.

“The reason we are promoting our own payments is because this will make the experience better for people who frequently use our platform,” Chen said.

Meituan’s rapid diversification however threatens to dilute its focus, in an industry where the biggest players switch positions routinely and expansion often entails serious cash burn. Those risks were underscored by tech conglomerate LeEco’s implosion.

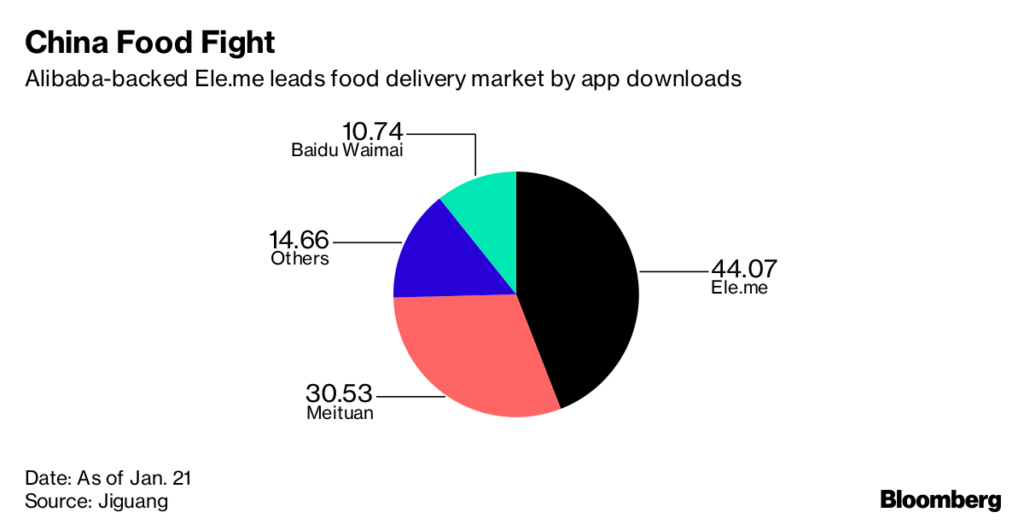

Meituan was the leader in a $38 billion food delivery arena, linking some 2 million restaurants across the country — but Alibaba-backed Ele.me now leads in app downloads, according to research firm Jiguang.

In travel, Meituan’s won the backing of Priceline Group Inc. but remains an also-ran against Ctrip.com International Ltd. and Alibaba’s “Fliggy.” And in ride-hailing, it’s up against Tencent-backed Didi.

Still, Meituan and its peers have little recourse but to explore new markets.

“The companies are hitting a ceiling in their own fields as they maximize the returns,” Zhou said. “Yet they all want high valuations and that’s why they need to expand. It’s very likely that we’ll see many becoming all-in-one super apps.”

—With assistance from David Ramli

©2018 Bloomberg L.P.

This article was written by Lulu Yilun Chen from Bloomberg and was legally licensed through the NewsCred publisher network. Please direct all licensing questions to [email protected].

![]()